The number and diversity of Fintech offerings is soaring. As banking clients increasingly often enjoy not only a better user experience, but also cheaper rates at Fintech firms, their willingness to be locked-in with one or two universal banks diminishes. Henceforth clients will gradually assemble their own individual “banks”, comprising a range of offerings from different Fintech companies. Those firms which will be able to provide an overarching structure to seamlessly wrap the multitude of Fintech offerings will experience their heydays.

Modern production technology allows what would have been inconceivable only a few decades ago. If we want, we can have products of mass production tailored to our needs nowadays. Dell made only the beginning when first assembling PCs to our requests on a large scale. Today we order our tailored sneakers at Nike ID, wear a unique t-shirt from Spreadshirt and eat M&M’s sporting our very own initials. Yet, the trend of mass customization did not stop in the manufacturing sector. We can already observe its ramifications in the financial services industry where Robo-Advisors offer retail customers to tailor their client portfolios. But this is not the end point of the evolution. It is the mere beginning which will eventually lead to tailored banks.

The personal balance sheet

Like it or not, every single one of us carries his or her own very personal balance sheet: On the asset side, we have liquid asset positions such as the cash that we have in our wallets, the money on our current accounts, our savings accounts or money market instruments. Our personal investments may comprise medium term notes, bonds, stocks, mutual funds, pension savings and/or alternative Investments. Finally, we may possess highly illiquid real estate investments such as our primary residences, vacation homes or even property that we rent out.

On the liability side we may also have a variety of items. Current liabilities may include unpaid bills, credit card balances, taxes due, installment loans due in the short run, consumer loans, car loans, student loans, mortgages due within one year etc. Non-current liabilities may include any consumer, car or student loan that is due after one year. Last but not least, we may have mortgage debt for our primary residence and/or vacation homes and/or rental property.

Hence, as individual as we are as human beings, as individual are our personal balance sheets. Yet, what we do have in common is that we willingly or unwillingly manage these balance sheets. We carry out treasury functions on our personal balance sheets by paying bills and installments, transferring money from one account to another, by investing in shares or by redeeming mutual funds etc.

The Fintech Alternative

So far many consumers in the western world have ties to one or two banks, oftentimes universal banks, that cater to all of the needs resulting from these treasury transactions. Yet, the service offerings of universal banks are increasingly rivaled by Fintech firms that offer a narrow, yet highly specialized service or product.

If you have a little cash to spare, Fintech firms such as Creditgate24, LendingClub or Crowdcube, have offerings for optimizing liquid assets. To manage longer term investments one can turn to providers such Wealthfront, Moneyfarm, Nutmeg, Addepar etc. On the liability side, too, there is a vast array of Fintech companies jockeying for position. Current and medium term liabilities may be optimized by using Affirm, Borro, Lendable, Prosper etc.

In order to transfer money from one provider or account to another the consumer can chose among dozens of payment providers such as TransferWise, LiquidPay, Paypal and the likes. For trading purposes the client may want to turn to eToro or Robinhood. Even donating money becomes easier and less burdensome with Fintech providers such as Elefunds.

These new type of financial services providers that found their niches on specific links of the value chains of universal banks typically not only promise their clients a better user experience, but also lower costs. What is thus foreseeable for the near future is that clients will no longer accept to be locked-in with one or two banks, but that they will make use of a range of financial service providers. Eventually every user will assemble his or her very own bank, the IBank* as I call it.

Assembling the IBank

The IBank will comprise a selection of services provided by specific Fintech companies handpicked by the individual client. This can happen dynamically and on an ad-hoc basis or on a more permanent base. The client – or an overlaying algorithm for that matter – may decide on a case-by-case basis which payment service would be optimal for a specific transfer. On a more longer term basis one mortgage provider may be chosen until the renewal of the mortgage is due.

What is important to note, however, is that clients will make use of tailored “banks” which may be as personal as their individual balance sheet. The challenge and opportunity in this future banking world will be to provide the glue that seamlessly keeps together these services provided by different providers. Those providers who manage to assemble and maintain an overarching structure that smoothly integrates the multitude of service offering of Fintech providers will have a bright future in finance services world which is being ever more atomized.

*IBank like “I bank” – not to be mistaken with the iBank offerings by Barclays, The Bank of Georgia, Fransabank, BCU and so on.

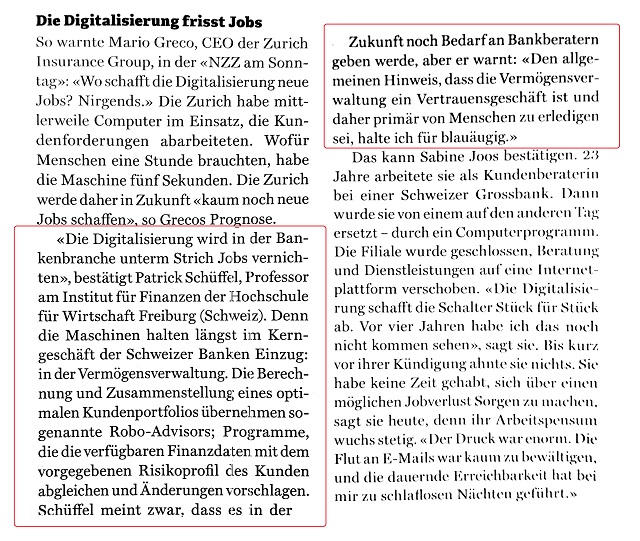

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion, Fribourg Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

If you want to read the complete edition of Best of the Web, Fiancial edition 13. Sep 2016, click

If you want to read the complete edition of Best of the Web, Fiancial edition 13. Sep 2016, click