„Banking as a Platform“ gewinnt an Bedeutung

(English version here)

VON PROF. DR. PATRICK SCHÜFFEL AM

Kunden erwarten zunehmend maßgeschneiderte, individuelle Angebote. Produktindividualisierung und Mass-Customization liegen im Trend. Auch die Zukunft von Banken und Sparkassen hängt angesichts der Konkurrenz durch FinTechs davon ab.v

Moderne Fertigungstechnologien erlauben, was vor wenigen Jahrzehnten noch unvorstellbar war. Wenn wir wollen, können wir heute Produkte aus der Massenproduktion beziehen, die dennoch auf unsere individuellen Bedürfnisse zugeschnitten sind. Michael Dell machte lediglich den Anfang, als er damit anfing, in großem Maßstab PCs nach individuellen Anforderungen zusammenzubauen. Heute bestellen wir unsere maßgeschneiderten Turnschuhe bei Nike ID, tragen ein einzigartiges T-Shirt von Spreadshirt und essen M & M’s mit unserer eigenen Initialen. Der Trend zur Mass-Customization endet jedoch nicht im verarbeitenden Gewerbe. Im Gegenteil, bereits heute können wir die Auswirkungen der Mass Customization in der Finanzdienstleistungsbranche beobachten, beispielsweise dort, wo Robo-Advisor die Kundenportfolios der Retail-Kundschaft anpassen. Aber das ist nicht der Endpunkt der Evolution. Es ist nur der Anfang, der schlussendlich zu maßgeschneiderten Banken führen wird.

Die individuelle Bilanz eines Bankkunden

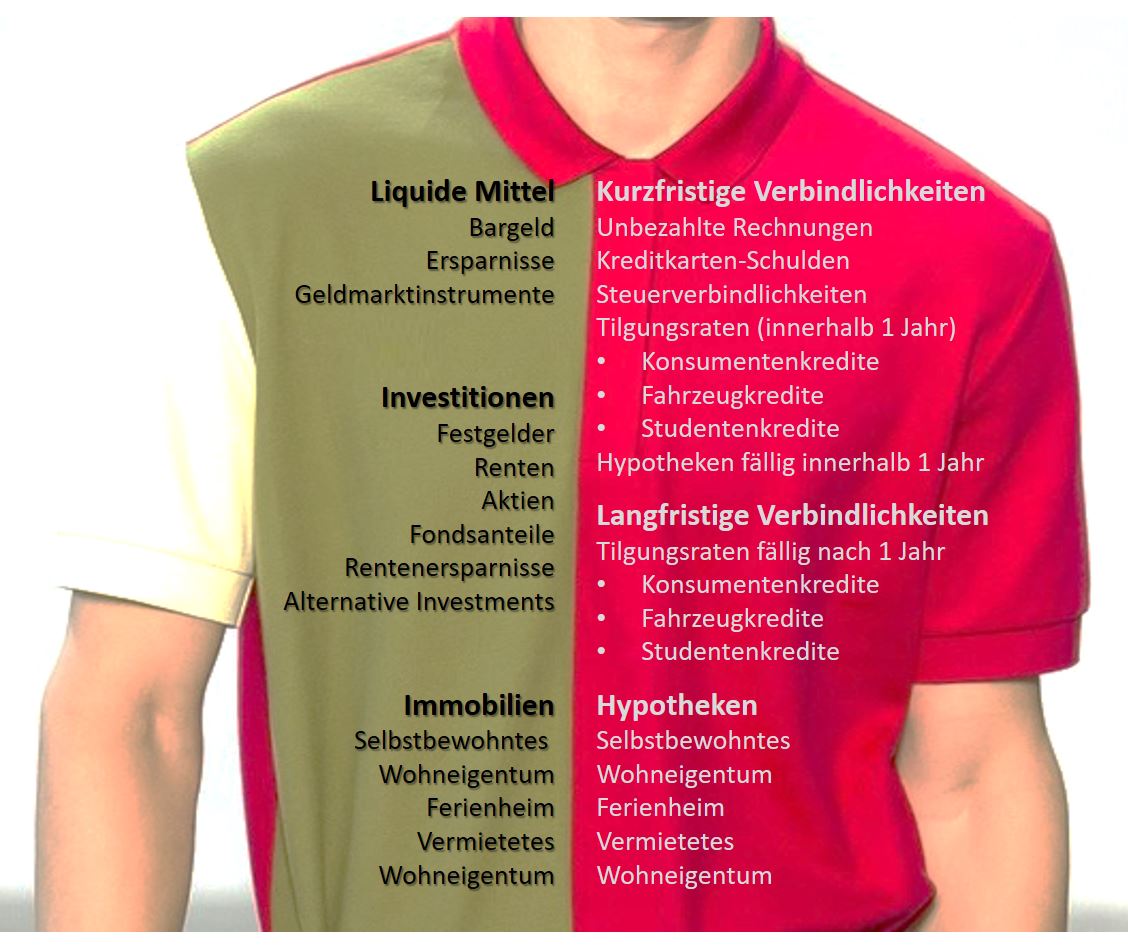

Ob man es mag oder nicht, jeder einzelne von uns besitzt seine eigene ganz persönliche Bilanz: Auf der Aktivseite besitzen wir flüssige Vermögenswerte wie das Bargeld, das wir in unseren Geldbeuteln herum tragen, das Geld auf unseren Giro- und Sparkonten sowie Geldmarktinstrumente. Unsere persönlichen Anlagen umfassen möglicherweise mittelfristige Schuldverschreibungen, Anleihen, Aktien, Investmentfonds, Rentenersparnisse und / oder alternative Anlagen. Schließlich können wir auch sehr illiquide Werte besitzen wie eigengenutzte Immobilien sowie Ferienhäuser oder sogar vermietetes Wohneigentum.

So individuell wie wir als Menschen sind, so individuell sind auch unsere persönlichen Bilanzen. Doch was wir als Verbraucher gemeinsam haben, ist, dass wir freiwillig oder unfreiwillig diese Bilanzen bewirtschaften. Wir führen Treasury-Funktionen auf unseren persönlichen Bilanzen durch, indem wir Rechnungen und Raten bezahlen, Geld von einem Konto zum anderen übertragen, indem wir Investition in Aktien tätigen oder durch die Rückgabe von Investmentfondsanteilen etc.

Die FinTech Alternative

In der westlichen Welt unterhalten viele Verbraucher Beziehungen zu einer oder zwei Banken – oftmals Universalbanken -, die allen Bedürfnissen entsprechen, welche sich aus den besagten Treasury-Transaktionen ergeben. Dennoch erhält das Serviceangebote der Universalbanken zunehmend Konkurrenz von FinTech-Firmen, deren Anzahl und Vielfalt der FinTech-Angebote kontinuierlich steigt. Sie bieten typischerweise eine sehr schmale Bandbreite von Services an, sind dabei jedoch hochspezialisiert und meist mit einer besseren User-Experience und günstigeren Preisen verbunden.

Wenn ein Bankkunde beispielsweise kleinere Summen sparen möchte, bieten FinTech-Firmen wie Creditgate24, LendingClub oder Crowdcube Angebote zur Optimierung von liquiden Mitteln. Um langfristige Investitionen zu verwalten, kann man sich an Anbieter wie Wealthfront, Moneyfarm, Nutmeg, Addepar etc. wenden. Auch auf der Passivseite gibt es eine breite Palette von FinTech-Firmen, die sich den verschiedenen Passivposten widmen. So können die kurz- und mittelfristigen Verbindlichkeiten beispielsweise durch die Verwendung von Affirm, Borro, Lendable, Prosper etc. optimiert werden.

Um Geld von einem Akteur bzw. Konto zu einem anderen zu übertragen, kann der Verbraucher unter Dutzenden von Zahlungsdienstleistern wie TransferWise, LiquidPay, Paypal und dergleichen wählen. Für den Wertpapierhandel kann sich der Kunde sich an eToro oder Robinhood wenden. Sogar das Spenden von Geld wird mit FinTech-Anbietern wie Elefunds komfortabler und effizienter.

Diese neuen Arten von Finanzdienstleistern, die ihre Nischen auf den einzelnen Gliedern der Wertschöpfungskette von Universalbanken gefunden haben, versprechen in der Regel nicht nur ihren Kunden eine bessere Nutzererfahrung, sondern auch geringere Kosten. Was für die nahe Zukunft vorhersehbar ist, ist, dass die Kunden es nicht länger akzeptieren werden, durch den Lock-in Effekt mit ein oder zwei Banken dauerhaft verbunden zu sein, sondern dass sie eine ganze Palette von verschiedenen Finanzdienstleistern nutzen werden. Schließlich wird diese Entwicklung dazu führen, dass jeder Kunde seine eigene Bank, die IBank , wie ich sie nenne, zusammenstellen wird. IBank ist dabei im Sinne von „Ich Bank“ gemeint und nicht zu verwechseln mit den iBank-Angeboten von Barclays, der Bank von Georgia, Fransabank, BCU etc.

Der Zusammenbau der IBank

Die IBank umfasst eine Auswahl von Dienstleistungen, welche von bestimmten FinTech-Unternehmen angeboten werden, und die von den einzelnen Kunden handverlesen werden. Dies kann dynamisch und ad-hoc oder auf einer dauerhafteren Basis geschehen. Der Kunde – oder ein übergreifender Algorithmus, der für diesen Zweck erarbeitet wurde – könnte so zum Beispiel von Fall zu Fall entscheiden, welcher Zahlungsdienst für eine individuelle Überweisung der bestgeeignetste wäre. Ebenso könnte der Kunde oder das System entscheiden, welcher Hypothekenanbieter idealerweise gewählt werden soll, um eine Hypothek abzulösen.

Es ist wichtig zu verstehen, dass Kunden künftig von „Banken“ Gebrauch machen werden, die ebenso persönlich auf die Bedürfnisse des Kunden zugeschnitten sein werden, wie es die individuelle Bilanz der Verbrauchers erfordert. Die Herausforderung und gleichsam Chance in dieser künftigen Bankenwelt ist es, die Plattform zu liefern, welche diese Dienstleistungen von verschiedenen Anbietern nahtlos zusammenführt (Banking as a Platform). Diejenigen Anbieter, die es schaffen, eine übergreifende Struktur zusammenzustellen und zu pflegen, welche es vermag, die Vielfalt der Dienstleistungsangebote von FinTech-Anbietern reibungslos zu integrieren, werden eine vielversprechende Zukunft haben. Angesichts einer Finanzdienstleistungsbranche, die zunehmend atomisiert wird, ist dies sicherlich ein lohnenswerter Ausblick.

WIE VERÖFFENTLICHT AUF “DER BANK BLOG”

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

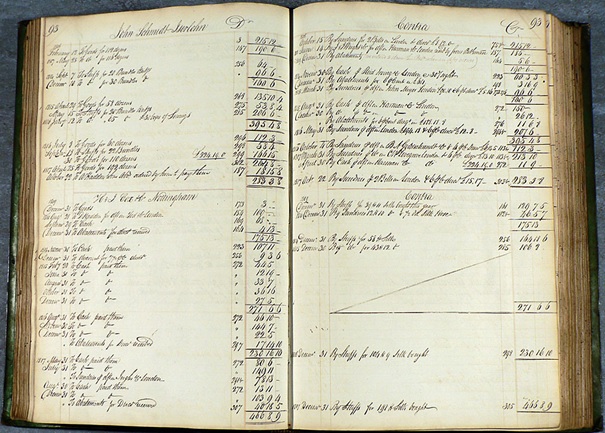

Seasoned private bankers often do not grasp the idea of the Blockchain. It was not until I understood that I was using the wrong vocabulary that I could convey what the Blockchain was all about.

Seasoned private bankers often do not grasp the idea of the Blockchain. It was not until I understood that I was using the wrong vocabulary that I could convey what the Blockchain was all about.