The article can be accessed in full length here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

The article can be accessed in full length here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

Thank you, Matthew Allen of Swissinfo for presenting my point of view on Bitcoin & Co.!

The article can be accessed in full length here.

The article can be accessed in full length here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

…and I am proud to see that my definition of Fintech is also catching being used in the French speaking parts of this world!

The full article can be accessed here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

“Do you know what Fintech is?” – I am thrilled to see that my definition of Fintech is also catching on in China!

The full article can be accessed here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

Some people call Bitcoin a Ponzi scheme. I tend to disagree as I do not believe that the inventors of Bitcoin intended to operate a fraudulent investment operation.

But Bitcoin does bear some commonalities with a Ponzi scheme. What is more, Bitcoin has the potential to bring down not only one major investment scheme, but multiple ones. Eventually it may turn out to be the Mother of All Pyramids (MOAP).

Common wisdom has it that a Ponzi scheme requires an initial investment and the incentive for above-average returns. Moreover, the early investors and promoters of Ponzi schemes typically profit from the lack of investor knowledge. As far as Bitcoin is concerned, the anchor investors and supporters certainly benefited from the bandwagon effect they had been creating. Moreover, as a second characteristic of a Ponzi scheme, high returns typically attract new investors.Without any doubt this is also the case with Bitcoin.

Thirdly, existing investors in the Ponzi scheme typically remain loyal to the system as they see their investments growing. If at all, only fractions of the investments are withdrawn. Here, too, I suspect that this is the case with Bitcoin. Hence, whilst Bitcoin may not be precisely a Ponzi scheme, the exponential inflow of money into the system in recent times are highly reminiscent of a pyramid.

If Bitcoin shares some characteristics with a Ponzi scheme, it is worth looking at how Ponzi schemes typically unravel. First, if authorities do not stop the scheme, the promoters of the scheme oftentimes just disappear, pocketing as much of the investments as possible.

A second possibility is that the continuous inflow of investment slows down and that therefore incumbent investors do not make the monetary gains that they were expecting, leading to a larger withdrawal of funds. Thirdly factors external to the scheme, such as an abrupt decline in the overall economy forces investors to withdraw funds, rendering the entire scheme unsustainable.

Again, giving the founders of Bitcoin the benefit of doubt, let us assume they do not suddenly just vanish after swiftly trading their Bitcoins into real assets. However, it cannot be ruled out that we either witness a slow-down in the investment flow into Bitcoin or a downturn in the overall economy. So what is going to happen next then?

Expressed in US Dollars Bitcoin has currently a market capitalization of appr. 134 bn. Given that this sum is larger than the governmental budget of Finland it is quite sizeable. A loss of these funds would represent a severe blow to many investors. But that is “only” Bitcoin. Taken together the twenty largest cryptocurrencies in terms of market capitalization make up an investment sum of more than USD 222 bn. which is appr. the governmental budget of Russia.

But what has Bitcoin to do with these other cryptocurrencies? I would argue a lot: Anyone who has invested in Bitcoin early on must have been positively surprised about the development of his or her investment. It is furthermore likely that these investors have kept a close eye on other initial coin offerings. After learning the rather positive lesson of investing in a cryptocurrency, these investors may have invested parts of the gains they made with Bitcoin in other cryptocurrencies.

So, if we assume that Bitcoin resembles a pyramid with investment inflows at the bottom and only fractional outflows at the top which are reinvested in other Cryptocurrencies, Bitcoin investors are likely to have created “clones” of their Bitcoin pyramid. These clones are likely to exist with other cryptocurrencies.

In other words, the pyramid is most likely not a simple pyramid any longer, but by now it most likely resembles a Sierpinski pyramid. This structure named after the Polish mathematician Wacław Sierpiński, is a showcase example of self-similar sets. In a rather scary fashion it reminds me of what we are potentially dealing with in terms of Bitcoin and cryptocurrency phenomenon. I therefore call this formation the Mother of all pyramids or “MOAP”.

Sierpinski pyramid, Wiki

Being largely an unregulated field only very little solid data is available on cryptocurrency investments. Yet, it is fairly safe to say that the afore mentioned USD 222 bn. invested in the twenty largest cryptocurrencies is not the entire sum that may be at stake. Not only have cryptocurrency ETFs and hedge funds been developed in the meantime, but investors can also put their money behind Bitcoin derivatives, such as options, futures and OTC forwards.

If we bring to mind that during its best times Lehman Brothers had “only” a market capitalization of USD 60 bn., its bankruptcy nevertheless marked a seminal event that intensified what later on became known as the Global Financial crises. This string of events eventually wiped out assets of appr. USD 1300 bn.

What will further fuel this process in the case of Bitcoin is the lack of liquidity: whilst it is unknow who precisely owns Bitcoins it is a fair assumption that the wealth distribution in the world of Bitcoin is even more uneven that in the world at large. In a major downturn the few owners of vast amounts of Bitcoin are unlikely to become buyers, but are more likely to join the selling party for diversification purposes. This lack of liquidity which could also be observed in the recent Bitcoin upswings will intensify the downward spiral.

On a positive note, however, some things are here to stay. The concept of the Blockchain which represents the underlying infrastructure for virtually any cryptocurrency will survive even the worst fallout. Even after Bitcoin and co. are gone, this seminal piece of technology will continue its triumphal procession in virtually any field of business across the globe.

This article appeared first on Fintechnews.ch on Nov. 20th 2017

My article on Swiss payent iniative Twint as featured on Fintech News Singapore (OCT 6th, 2017):

To access full article, click here.

To access full article, click here.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion, Fribourg Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

(English version here)

VON PROF. DR. PATRICK SCHÜFFEL AM

Kunden erwarten zunehmend maßgeschneiderte, individuelle Angebote. Produktindividualisierung und Mass-Customization liegen im Trend. Auch die Zukunft von Banken und Sparkassen hängt angesichts der Konkurrenz durch FinTechs davon ab.v

Moderne Fertigungstechnologien erlauben, was vor wenigen Jahrzehnten noch unvorstellbar war. Wenn wir wollen, können wir heute Produkte aus der Massenproduktion beziehen, die dennoch auf unsere individuellen Bedürfnisse zugeschnitten sind. Michael Dell machte lediglich den Anfang, als er damit anfing, in großem Maßstab PCs nach individuellen Anforderungen zusammenzubauen. Heute bestellen wir unsere maßgeschneiderten Turnschuhe bei Nike ID, tragen ein einzigartiges T-Shirt von Spreadshirt und essen M & M’s mit unserer eigenen Initialen. Der Trend zur Mass-Customization endet jedoch nicht im verarbeitenden Gewerbe. Im Gegenteil, bereits heute können wir die Auswirkungen der Mass Customization in der Finanzdienstleistungsbranche beobachten, beispielsweise dort, wo Robo-Advisor die Kundenportfolios der Retail-Kundschaft anpassen. Aber das ist nicht der Endpunkt der Evolution. Es ist nur der Anfang, der schlussendlich zu maßgeschneiderten Banken führen wird.

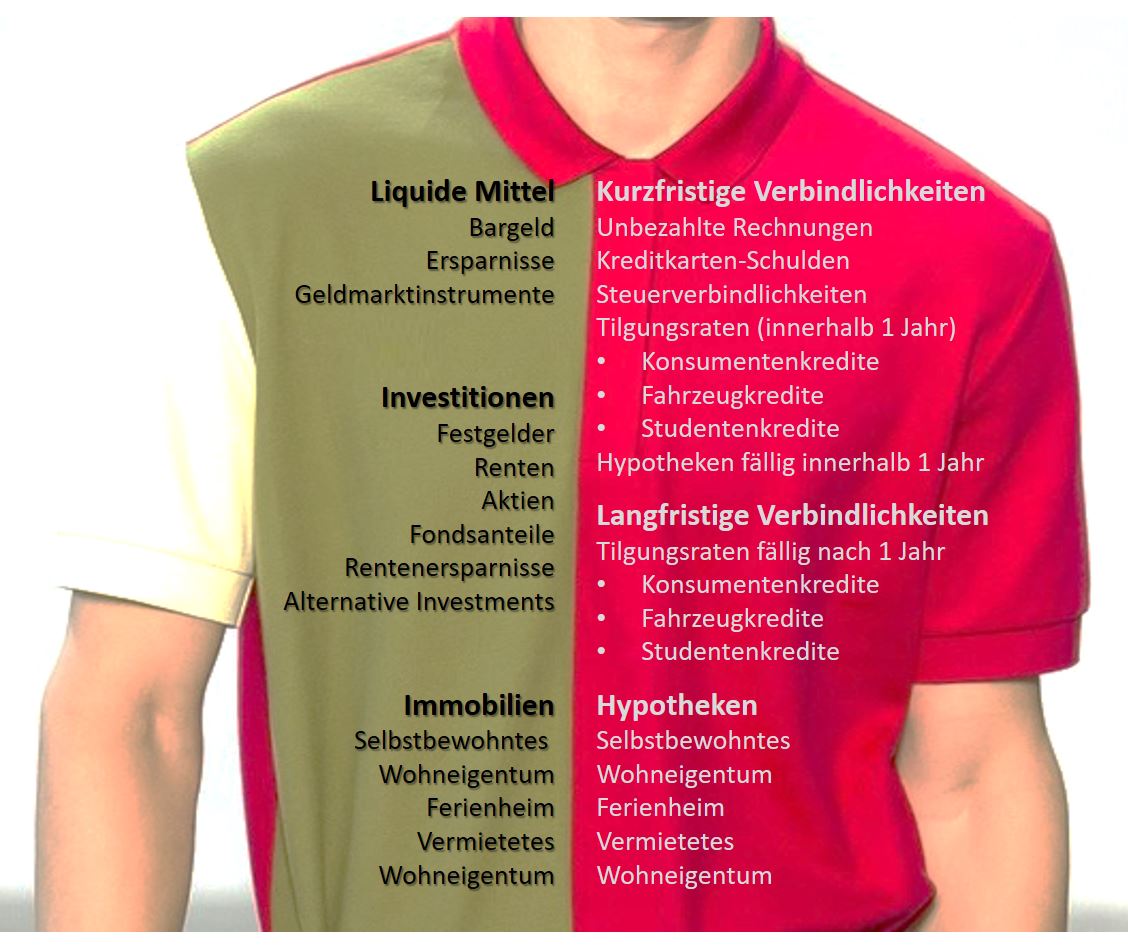

Ob man es mag oder nicht, jeder einzelne von uns besitzt seine eigene ganz persönliche Bilanz: Auf der Aktivseite besitzen wir flüssige Vermögenswerte wie das Bargeld, das wir in unseren Geldbeuteln herum tragen, das Geld auf unseren Giro- und Sparkonten sowie Geldmarktinstrumente. Unsere persönlichen Anlagen umfassen möglicherweise mittelfristige Schuldverschreibungen, Anleihen, Aktien, Investmentfonds, Rentenersparnisse und / oder alternative Anlagen. Schließlich können wir auch sehr illiquide Werte besitzen wie eigengenutzte Immobilien sowie Ferienhäuser oder sogar vermietetes Wohneigentum.

So individuell wie wir als Menschen sind, so individuell sind auch unsere persönlichen Bilanzen. Doch was wir als Verbraucher gemeinsam haben, ist, dass wir freiwillig oder unfreiwillig diese Bilanzen bewirtschaften. Wir führen Treasury-Funktionen auf unseren persönlichen Bilanzen durch, indem wir Rechnungen und Raten bezahlen, Geld von einem Konto zum anderen übertragen, indem wir Investition in Aktien tätigen oder durch die Rückgabe von Investmentfondsanteilen etc.

In der westlichen Welt unterhalten viele Verbraucher Beziehungen zu einer oder zwei Banken – oftmals Universalbanken -, die allen Bedürfnissen entsprechen, welche sich aus den besagten Treasury-Transaktionen ergeben. Dennoch erhält das Serviceangebote der Universalbanken zunehmend Konkurrenz von FinTech-Firmen, deren Anzahl und Vielfalt der FinTech-Angebote kontinuierlich steigt. Sie bieten typischerweise eine sehr schmale Bandbreite von Services an, sind dabei jedoch hochspezialisiert und meist mit einer besseren User-Experience und günstigeren Preisen verbunden.

Wenn ein Bankkunde beispielsweise kleinere Summen sparen möchte, bieten FinTech-Firmen wie Creditgate24, LendingClub oder Crowdcube Angebote zur Optimierung von liquiden Mitteln. Um langfristige Investitionen zu verwalten, kann man sich an Anbieter wie Wealthfront, Moneyfarm, Nutmeg, Addepar etc. wenden. Auch auf der Passivseite gibt es eine breite Palette von FinTech-Firmen, die sich den verschiedenen Passivposten widmen. So können die kurz- und mittelfristigen Verbindlichkeiten beispielsweise durch die Verwendung von Affirm, Borro, Lendable, Prosper etc. optimiert werden.

Um Geld von einem Akteur bzw. Konto zu einem anderen zu übertragen, kann der Verbraucher unter Dutzenden von Zahlungsdienstleistern wie TransferWise, LiquidPay, Paypal und dergleichen wählen. Für den Wertpapierhandel kann sich der Kunde sich an eToro oder Robinhood wenden. Sogar das Spenden von Geld wird mit FinTech-Anbietern wie Elefunds komfortabler und effizienter.

Diese neuen Arten von Finanzdienstleistern, die ihre Nischen auf den einzelnen Gliedern der Wertschöpfungskette von Universalbanken gefunden haben, versprechen in der Regel nicht nur ihren Kunden eine bessere Nutzererfahrung, sondern auch geringere Kosten. Was für die nahe Zukunft vorhersehbar ist, ist, dass die Kunden es nicht länger akzeptieren werden, durch den Lock-in Effekt mit ein oder zwei Banken dauerhaft verbunden zu sein, sondern dass sie eine ganze Palette von verschiedenen Finanzdienstleistern nutzen werden. Schließlich wird diese Entwicklung dazu führen, dass jeder Kunde seine eigene Bank, die IBank , wie ich sie nenne, zusammenstellen wird. IBank ist dabei im Sinne von „Ich Bank“ gemeint und nicht zu verwechseln mit den iBank-Angeboten von Barclays, der Bank von Georgia, Fransabank, BCU etc.

Die IBank umfasst eine Auswahl von Dienstleistungen, welche von bestimmten FinTech-Unternehmen angeboten werden, und die von den einzelnen Kunden handverlesen werden. Dies kann dynamisch und ad-hoc oder auf einer dauerhafteren Basis geschehen. Der Kunde – oder ein übergreifender Algorithmus, der für diesen Zweck erarbeitet wurde – könnte so zum Beispiel von Fall zu Fall entscheiden, welcher Zahlungsdienst für eine individuelle Überweisung der bestgeeignetste wäre. Ebenso könnte der Kunde oder das System entscheiden, welcher Hypothekenanbieter idealerweise gewählt werden soll, um eine Hypothek abzulösen.

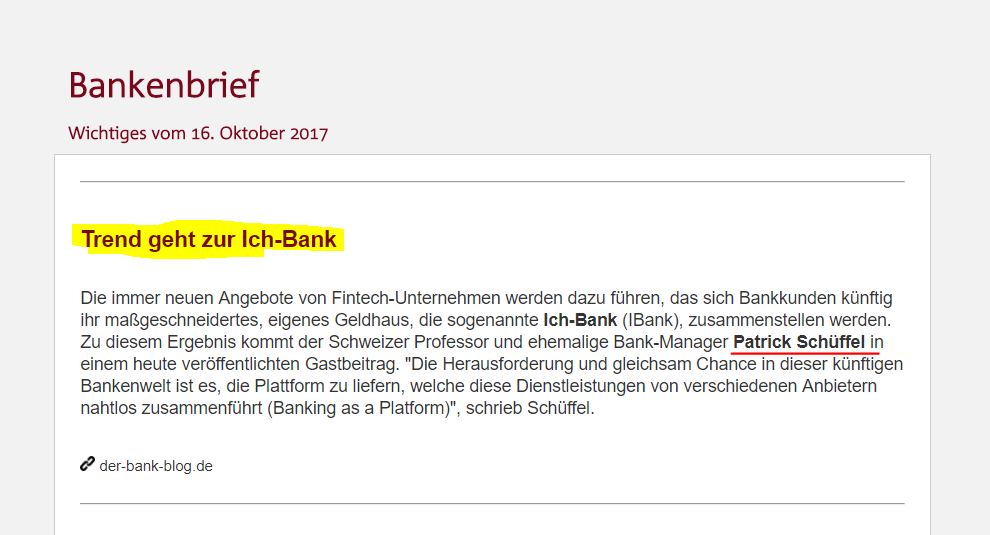

Es ist wichtig zu verstehen, dass Kunden künftig von „Banken“ Gebrauch machen werden, die ebenso persönlich auf die Bedürfnisse des Kunden zugeschnitten sein werden, wie es die individuelle Bilanz der Verbrauchers erfordert. Die Herausforderung und gleichsam Chance in dieser künftigen Bankenwelt ist es, die Plattform zu liefern, welche diese Dienstleistungen von verschiedenen Anbietern nahtlos zusammenführt (Banking as a Platform). Diejenigen Anbieter, die es schaffen, eine übergreifende Struktur zusammenzustellen und zu pflegen, welche es vermag, die Vielfalt der Dienstleistungsangebote von FinTech-Anbietern reibungslos zu integrieren, werden eine vielversprechende Zukunft haben. Angesichts einer Finanzdienstleistungsbranche, die zunehmend atomisiert wird, ist dies sicherlich ein lohnenswerter Ausblick.

WIE VERÖFFENTLICHT AUF “DER BANK BLOG”

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion Fribourg, Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

Es freut mich zu sehen, dass der Bankenverband meine Ideen zur Ich-Bank aufgegriffen und in seinem Bankenbrief vom 16.10.2017 skizziert hat!

Link zum Bankbrief: hier

Link zum Bankbrief: hier

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion, Fribourg Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

In Switzerland a consortium made up by some of the country’s largest banks such UBS, Credit Suisse, Postfinance etc. attempts to introduce a new mobile payment system and digital wallet by the name of Twint. So far it has failed miserably. The question that arises is what the future holds in store for Twint: will it succeed or fail in the long run?

Spoiler alert: I hate to say it, but this Swiss mobile payment system was doomed to fail from the outset. Nonetheless, not all hope is gone.

The value of networks

But let’s take it step by step. When pondering current business issues, it can be useful to consult some old economics classics. In their 1994 work “Systems competition and network effects” Katz and Shapiro describe the term network effects by saying that the ”value of membership to one user is positively affected when another user joins and enlarges the network, such markets are said to exhibit ‘network effects’” (p.94). In other words, in certain areas the success of a novel technology will depend on the size of the user group. This is because every additional user adds value to the entire system. Payments is such a technology. The more adopters there are of one specific technology, the more valuable it becomes to the group of users as everyone can transfer money to each other.

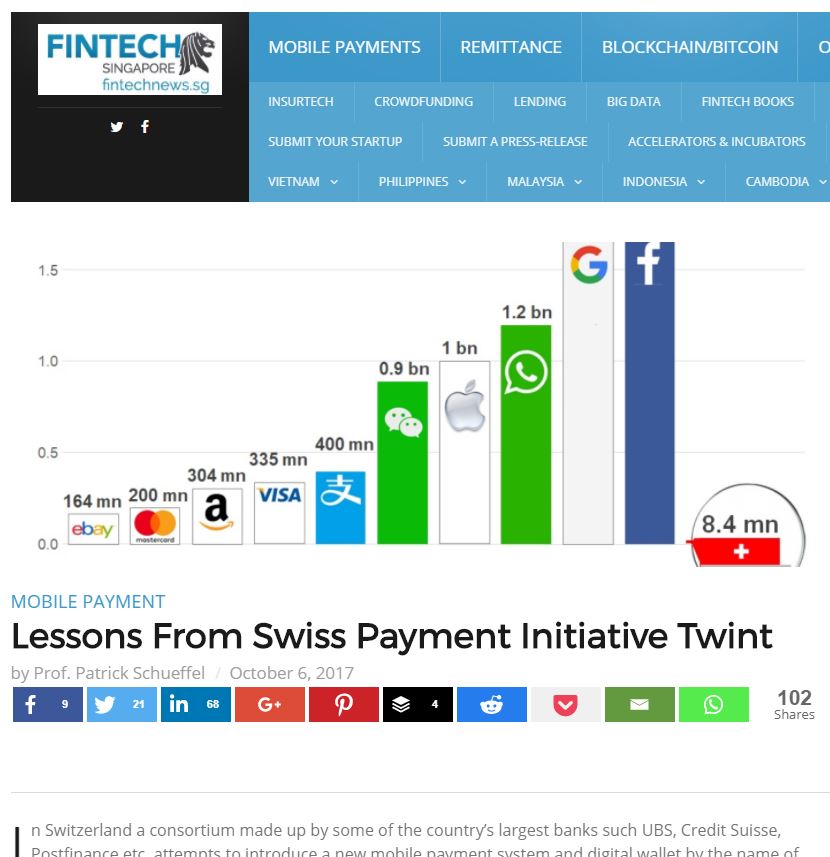

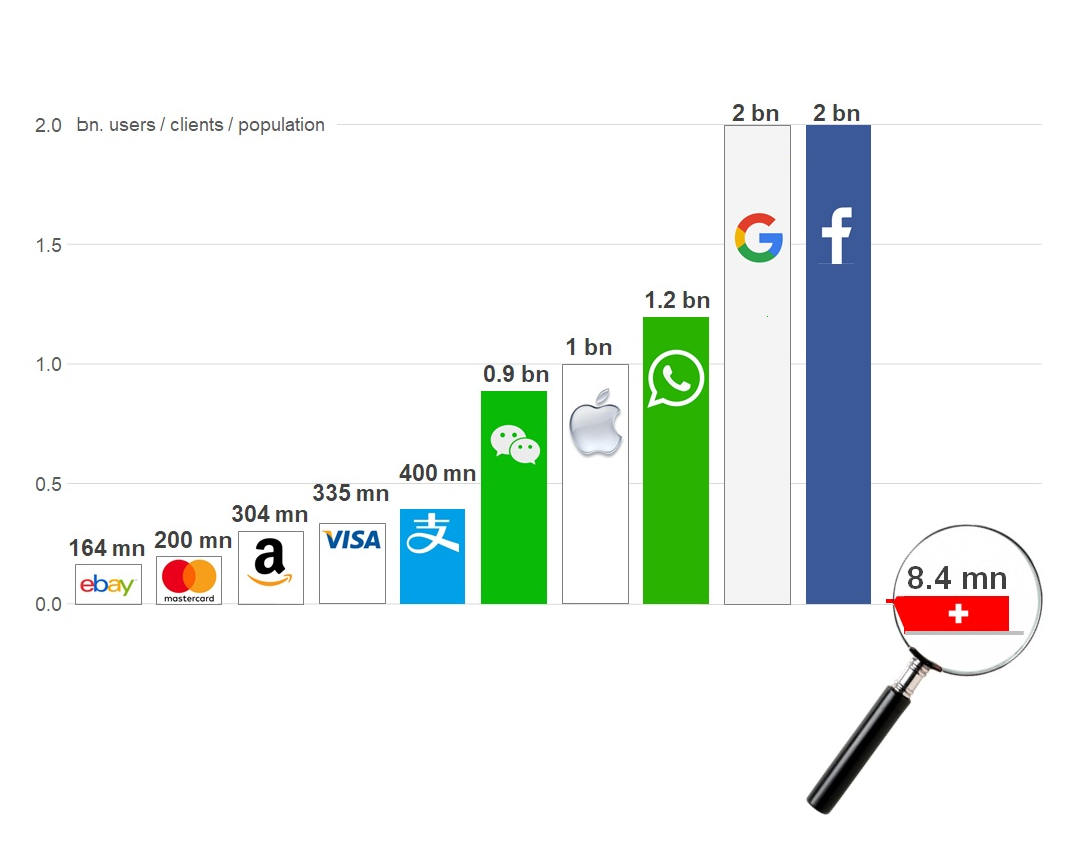

As legal tender cash has by definition a network size of the entire population of a country plus it is businesses. This can be rather sizeable, depending on the population of a nation. Yet, entire nations may still be small compared to other organizations and their network sizes, such as the likes of Facebook, Google and so on:

Let’s assume for a second Twint came without technical flaws (it did not) and that its user friendliness was at par with Facebook, Google, WhatsApp etc. (it is not) and that the entire Swiss population was made up of Twint clients (of course, they are not!). Even then, the entire network Twint serves, will merely comprise 8 million people. Or to put it in Katz and Shapiro’s words: Only 8 million people positively affect each other, compared to the potential 2’000 million users in the case of Google.

Moreover, imagine a Swiss Twint client travelling abroad and intending to use his or her mobile phone for payments. As Twint is a national solution, the client will most likely be forced to use a different service, one offered by an international player, such as Apple Pay. It is then much more likely that Apple with its customer base of 1000 million users will push the Twint App off the phone over time. Instead, Apple pay will conquer Switzerland rather than Twint will conquer the world from its minute Swiss base.

To put it in a nutshell, as a lone warrior Twint was foredoomed from the beginning. The base network size is far from any threshold that would yield appreciable benefits to the network members.

One chance: Team up!

But not all hope is lost if the responsible people involved understand the lesson taught be Katz and Shapiro: you need to team up with someone who already has a sizable network. Here various players come to mind. Among those are some which Swiss banks already have close ties to and which are not new to payments, such as the credit card firms Mastercard and Visa. Piggybacking on a 200 million or 335 million user network is far better than attempting to build up a network from the scratch that is basically limited to a few million users. Moreover, it could also be a value proposition to those existing networks: one the one hand, such existing networks could be expanded by a couple of million users, but first and foremost, Twint could introduce new technologies to those networks which would help them to evolve. However, this approach also requires a change of mindset. Twint must give up its role as a lone Swiss fighter and become an international team player.

To put it at its simplest, no matter how well established you are domestically, any payment system that is constrained by a rather small user base and thus network size must look for international partners with larger networks from the outset. Only if those local payment systems team up with other international players and leverage those players’ networks, they will have a chance of success.

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion, Fribourg Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch

Do you sometimes feel lost in the Fintech jungle? Then this booklet may be the right guide for you:

More than 130 Fintech terms, acronyms and abbreviations explained in plain English.

Download your free copy here:

Download your free copy here:

Schueffel (2017) The Concise FINTECH COMPENDIUM

Author: Schueffel, Patrick

Year: 2017

Title: The Concise Fintech Compendium

Place Published: Fribourg, Switzerland

Publisher: School of Management Fribourg, Switzland

Reference Type: Book

ISBN: 9782940384440

Dr. Patrick Schüffel, Professsor, Institute of Finance, Haute école de gestion, Fribourg Chemin du Musée 4, CH-1700 Fribourg, patrick.schueffel@hefr.ch, www.heg-fr.ch