Fintech is steaming ahead at an incredible pace. What robots used to be for the automotive industry, algorithms have become to the banking industry.

Common wisdom had it that one’s job would be secure if one was well educated and kept up-to-date on the job. Now, however, we are increasingly facing a situation when even highly sophisticated occupations such as personal finance advisors as well as accountants and auditors will fall prey to digitalization.

The Future of Employment

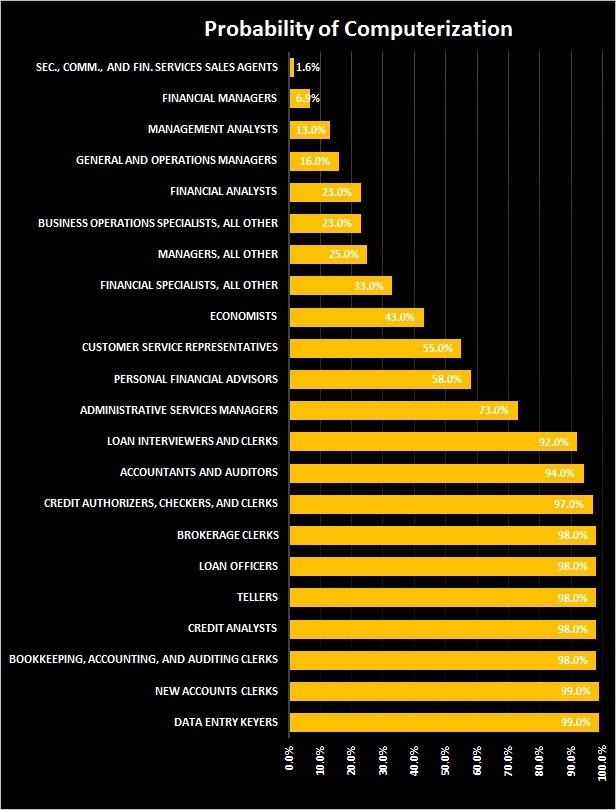

In their 2013 study “The Future of Employment” Karl Benedikt Frey and Michael Osborne estimated the probability of computerization for 702 professions based on three factors: perception and manipulation tasks, creative intelligence tasks and social intelligence tasks.

Applied to Banking

Of those occupations examined by Frey and Osborne I have extracted those that I find relevant to the banking industry. The percentage figure displayed indicates the likelihood of that profession being computerized in “a decade or two”, i.e. between 2023 and 2033.

Occupation: Probability of Computerization

Sec., Commod., and Fin. Services Sales Agents: 1.6%

Financial Managers: 6.9%

Management Analysts: 13.0%

General and Operations Managers: 16.0%

Financial Analysts: 23.0%

Business Operations Specialists, All Other: 23.0%

Managers, All Other: 25.0%

Financial Specialists, All Other: 33.0%

Economists: 43.0%

Customer Service Representatives: 55.0%

Personal Financial Advisors: 58.0%

Administrative Services Managers: 73.0%

Loan Interviewers and Clerks: 92.0%

Accountants and Auditors: 94.0%

Credit Authorizers, Checkers, and Clerks: 97.0%

Tellers: 98.0%

Loan Officers: 98.0%

Credit Analysts: 98.0%

Brokerage Clerks: 98.0%

Bookkeeping, Accounting, and Auditing Clerks: 98.0%

New Accounts Clerks: 99.0%

Data Entry Keyers: 99.0%

Dr. Patrick Schüffel, A.Dip.C., M.I.B., Dipl.-Kfm.

Professsor

Institute of Finance

Haute école de gestion Fribourg

Chemin du Musée 4

CH-1700 Fribourg

patrick.schueffel@hefr.ch, www.heg-fr.ch